Once you know that you have a net loss on your hands, you can use contribution margin ratio to figure out what you need to do to break even. But you could also increase sales by $200,000 without increasing variable expenses. The contribution margin is affected by the variable costs of producing a product and the product’s selling price. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits.

Increase Contribution Margin Ratio By Controlling Labor Costs

The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors. The more customers she serves, the more food and beverages she must buy.

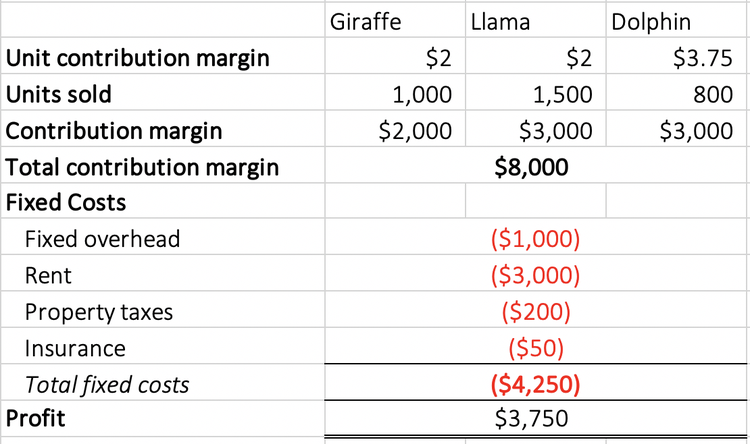

Contribution Margin

Fixed costs are used in the break even analysis to determine the price and the level of production. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs.

Variable cost

- There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs.

- Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows.

- It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs.

Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license.

Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. On the other hand, variable costs are costs that depend on the amount of goods and services a business produces.

What is a Good Contribution Margin?

Selling price per unit times number of units sold for Product A equals total product revenue. Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is types of business bank accounts $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid.

So, 60% of your revenue is available to cover your fixed costs and contribute to profit. Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses.

And to understand each of the steps, let’s consider the above-mentioned Dobson example. Now, the fixed cost of manufacturing packets of bread is $10,000. Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows. Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability.

The benefit of expressing the contribution margin as a percentage is that it allows you to more easily compare which products are the most valuable to your business. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.